Zimbabwe economy: New bond coins in circulation for Christmas

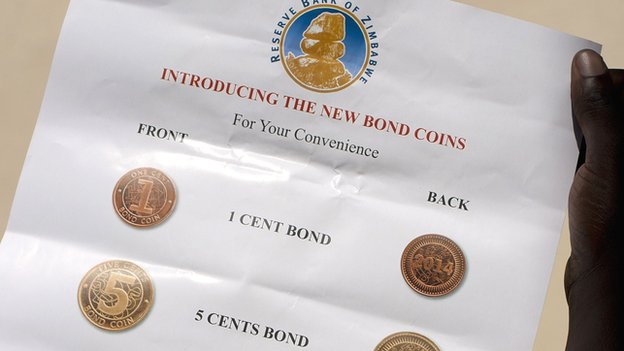

Special coins issued by Zimbabwe’s central bank have gone into circulation in the run-up to Christmas.

Zimbabwe abandoned its currency in 2009 due to hyperinflation and mainly uses the US dollar and South African rand.

But with very few coins for the US Dollar and SA rand in actual circulation, shoppers are given change in sweets or pens.

The central bank governor did promise that there were no plans to reintroduce the Zimbabwean dollar and the new bond coins would be pegged to the US dollar. Take this statement as you will, question being if you trust the Zimbabwe Government?

John Mangudya said US$10m (£6.3m) worth of bond coins – in one cent, five cent, 10 cent and 25 cent denominations – had so far been distributed to banks.

Zimbabwe’s state-owned Herald newspaper reports reported that the total amount in circulation would not exceed US$50m.

‘Financially traumatised’

Analysts say the shortage of US$ coins has kept prices high as retailers often round them up, which has affected Zimbabwe’s economic growth on a drastic scale.

“Through the introduction of change in small denominations we are expecting to see self price corrections,” the Governor, Mr Mangudya is quoted by The Herald as saying last Thursday.

Zimbabwe’s private Daily News paper reported the central bank governor as describing his country as a “financially traumatised society”.

Towards the end of 2008, annual inflation had reached a staggering 230 million % with the highest denomination being a $100 trillion Zimbabwean dollar note.

Prices in retail shops changed by the hour, most schools and hospitals were forced to close and at least eight in 10 people found themselves out of work.

The economy has since stabilised since switching to the $US and South African rand however many Zimbabweans still struggle to make ends meet.

President Robert Mugabe has appointed John Mangudya, the head of Zimbabwe’s largest financial institution, as the governor of the central bank back in early 2014.

Mangudya, 51, who was the chief executive of CBZ Holdings, replaced Gideon Gono, who retired last November at the expiry of his second term. Gono is also a former CBZ chief executive.

CBZ has been handling the government’s consolidated revenue account since 2009, when the economy dollarized and left the under capitalised central bank unable to fully perform its roles in the economy.

Mangudya, a University of Zimbabwe-trained economist, started his five year term from May 1.

Mandudya profile:

A Methodist born 5 October 1963 in Mutambara, Chimanimani, the last in a family of 12. An affable economist, with a slight stutter. Considers himself an adherent of Keynesian demand-side economics

1986 – Joined Reserve Bank of Zimbabwe as an economist

1996 – left RBZ, having risen to become Principal Economist

1996 to 1999 –Joined the African Export and Import Bank (Afreximbank) as the regional manager in charge of Southern Africa based in Harare.

2000 – CBZ Bank General Manager, International Banking CBZ Bank managing director

2004 – CBZ Bank Executive Director – Corporate and Merchant Banking

2006 – Appointed CBZ Bank Managing Director

2012 – CBZ Holdings Group Chief Executive

2009 -11 Bankers Association of Zimbabwe President

Under his watch, CBZ Holdings has grown both assets and deposits above $1 billion

Leave a Reply

Want to join the discussion?Feel free to contribute!